When chiropractors and attorneys find out my background is in investing, they always ask me my opinion of where they should invest their money hoping for a stock tip. My answer is always, always, always: invest your money inside your own firm. I wish I could invest in a law firm, but the law is not on my side (unless I want to move to DC that is).

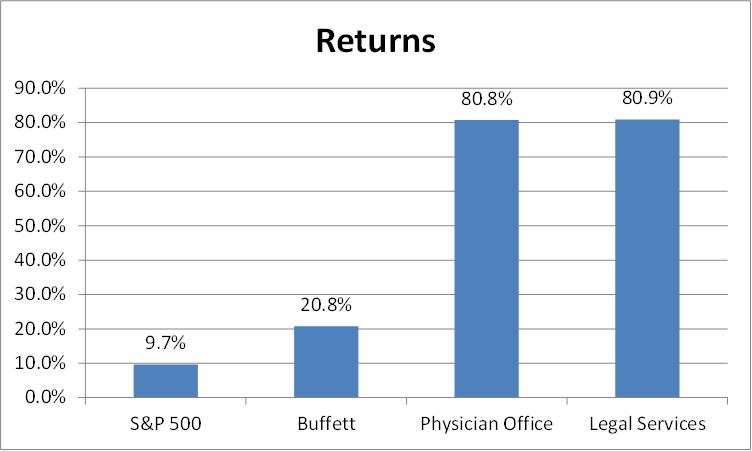

First – a quick bit of background….Warren Buffett, who is considered one of the best investors in the world, disclosed that Berkshire Hathaway’s 2015 letter to investors (which is an awesome read by the way... they all are) has generated a compound annual gain since 1965 of 20.8% compared to the S&P 500’s 9.7%. Doubling the compounded rate or return of the stock market for 50 years has made Buffett one of the world’s richest people (worth over $60 billion according to the latest Forbes survey).

According to Sageworks, the return on equity for physicians’ offices and other health care practitioners and legal services is just a little over 80%. So… your firm (whether it be a chiropractor office or law firm) generates a return on equity almost 8X better than the stock market in general and 4X better than one of the world’s greatest investors….

Where would you rather invest your money?

But…what does that mean….and how do you “invest in your business”?

Let’s start with what does it mean…

Let’s say you had $10,000 at the end of the year to invest – some cash you saved up in your rainy day fund that you now want to put to work.

If you invested that $10,000 and “let it roll” or reinvested all proceeds (dividends, etc.) back into the same investment your $10,000 would compound at the rates provided above. Over 1 year, 10% and 80% are a big difference… but over 5 years… it’s huge with the investment in a physician or legal practice growing to almost $200 thousand, while Buffett would have grown to only $25 thousand.

5 years of compounding really adds up...where can I sign up?

So how do you invest in your own business?

For a law or chiropractic firm, investing in the business entails typically one of two things:

- Putting more cash into the firm for new projects

- Leaving cash in the firm and not paying every extra dollar out as a dividend

So now that you have more cash… what do you do with it?

Here is where some financial analysis and return on investment calculations comes in handy. There is really only one goal when investing in your business – increasing the bottom line income. There are two ways to do this though:

- Increase revenues

- Decrease costs

Let’s focus on increasing revenues… the best way to do that is to invest in effective marketing.

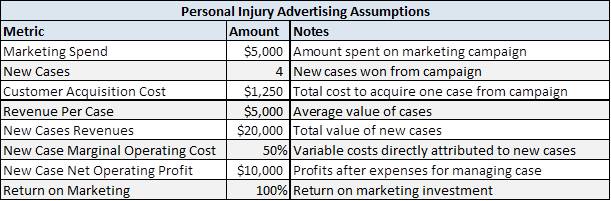

Let’s look at the average personal injury case for an attorney (please let me know if you disagree with my assumptions). If you’re an attorney, that case is worth around $5,000 and up (including built in losses and write-downs of case value, etc.). To get that incremental case, you need to invest in marketing. The return on investment for your marketing is dependent on your Customer Acquisition Cost.

Now, let’s assume you run an advertising campaign and it costs you $5,000 and you get four cases from it as a result. Your customer acquisition cost would be $1,250 per case… which sounds expensive, BUT each case is worth $5,000 or more so it was expensive, but worth it. Your return on investment for $5,000 was $20,000 of revenue. That is 4x your investment… even at an absurdly high marginal cost per case of 50%, if you only netted $10,000 from those cases, you’d still be making a return of 100% on your original investment. If you multiply this over and over, you can see how advertising can generate amazing returns on investment for your firm over time…